The 8-Minute Rule for Financial Advisor Magazine

Wiki Article

9 Simple Techniques For Advisor Financial Services

Table of ContentsFascination About Financial AdvisorFascination About Advisors Financial Asheboro NcThe 10-Minute Rule for Financial AdvisorThe Ultimate Guide To Financial Advisor Ratings

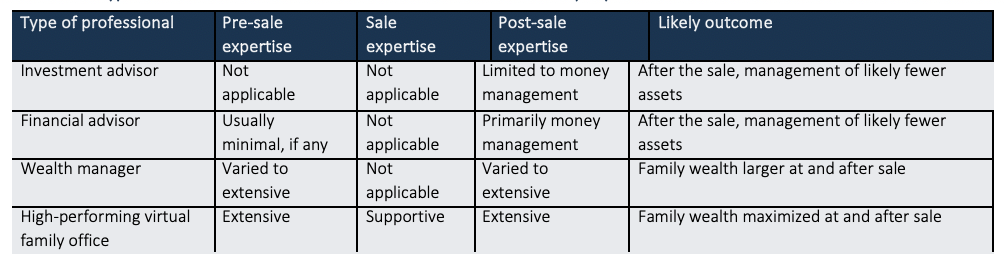

There are numerous types of economic advisors available, each with varying qualifications, specialties, as well as degrees of liability. As well as when you're on the search for a specialist suited to your demands, it's not unusual to ask, "Just how do I know which monetary expert is best for me?" The response begins with a truthful bookkeeping of your demands and a little bit of study.That's why it's vital to research potential experts and also recognize their credentials before you turn over your money. Kinds Of Financial Advisors to Take Into Consideration Depending on your financial demands, you might go with a generalized or specialized economic expert. Recognizing your alternatives is the initial step. As you begin to study the world of seeking out a financial expert that fits your requirements, you will likely be provided with many titles leaving you questioning if you are calling the appropriate person.

It is necessary to keep in mind that some monetary experts additionally have broker licenses (meaning they can offer safety and securities), however they are not entirely brokers. On the exact same note, brokers are not all accredited similarly as well as are not monetary consultants. This is just among the several factors it is best to begin with a qualified financial planner that can recommend you on your financial investments and retired life.

Not known Details About Financial Advisor License

Unlike financial investment consultants, brokers are not paid directly by customers, instead, they make payments for trading supplies and bonds, as well as for selling mutual funds as well as various other products.

You can normally tell an expert's specialized financial advisor meaning from his or her economic accreditations. For instance, a recognized estate planner (AEP) is a consultant that specializes in estate planning. When you're looking for a financial advisor, it's good to have an idea what you desire assistance with. It's additionally worth discussing economic planners. financial advisor jobs.

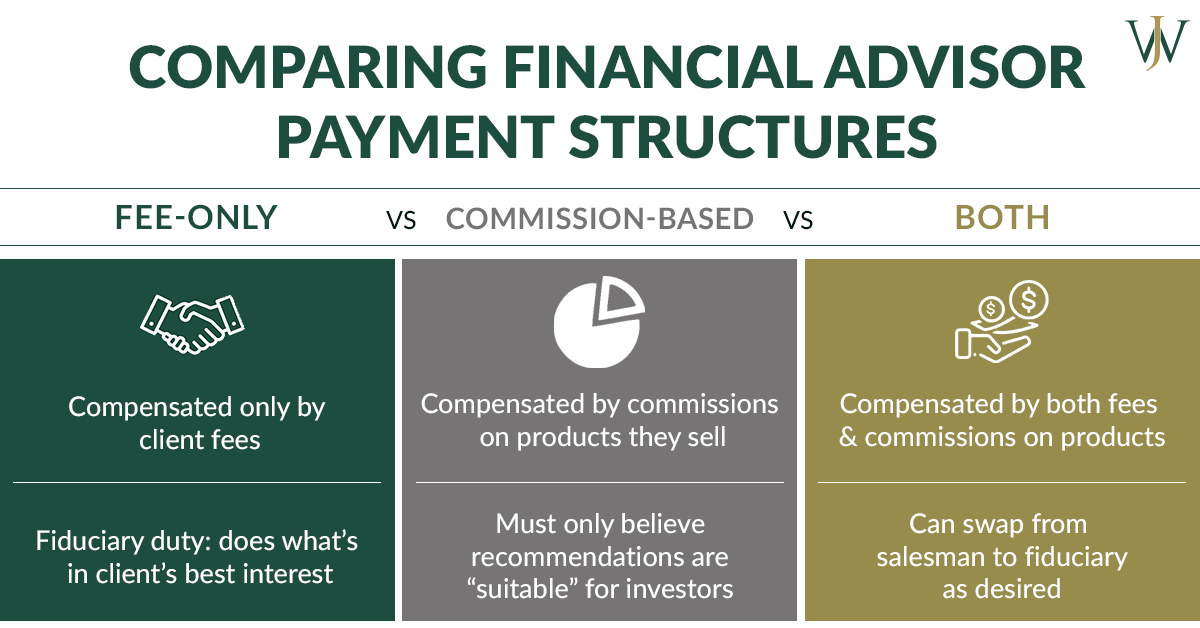

Just like "financial expert," "economic planner" is likewise a wide term. Somebody with that title can likewise have other qualifications or specializeds. Despite your particular requirements as well as monetary scenario, one requirements you must strongly take into consideration is whether a potential advisor is a fiduciary. It may shock you to discover that not all economic advisors are required to act in their clients' finest interests.

The Only Guide for Financial Advisor Ratings

To protect yourself from someone who is merely attempting to obtain more cash from you, it's an excellent concept to seek an expert that is signed up as a fiduciary. An economic advisor who is registered as a fiduciary is called for, by legislation, to act in the very best interests of a client.Fiduciaries can just encourage you to utilize such products if they believe it's in fact the most effective monetary decision for you to do so. The United State Securities and Exchange Commission (SEC) controls fiduciaries. Fiduciaries that stop working to act in a client's benefits might be hit with fines and/or jail time of approximately one decade.

Nevertheless, that isn't because anybody can obtain them. Getting either qualification needs Visit Your URL a person to go with a variety of classes as well as tests, in addition to making a set amount of hands-on experience. The result of the qualification process is that CFPs as well as Ch, FCs are well-versed in topics throughout the field of personal finance.

The charge could be 1. Costs usually lower as AUM rises. The alternative is a fee-based consultant.

Facts About Financial Advisor Meaning Uncovered

An expert's management fee may or may not cover the costs associated with trading safeties. Some advisors likewise charge a set fee per purchase.

This is a service where the consultant will bundle all account management prices, consisting of trading fees and cost proportions, right into one thorough charge. Since this charge covers more, it is typically more than a fee that only includes monitoring and omits points like trading expenses. Wrap costs are appealing for their simpleness yet also aren't worth the expense for everyone.

While a traditional expert typically charges a charge in between 1% and 2% of AUM, the fee for a robo-advisor is generally 0. The huge compromise with a robo-advisor is that you usually don't have the capacity to speak with a human consultant.

Report this wiki page